There are two ways for you to buy or sell a product in Future Trader, either from Watchlists or from the Quick Trade Ticket.

Placing a Trade/Order from Watchlists

1.Select a product to be traded, click the . Alternatively, after selecting the product, you can double click on the product or right click on the product and choose the Open Trade/Order option from the menu.

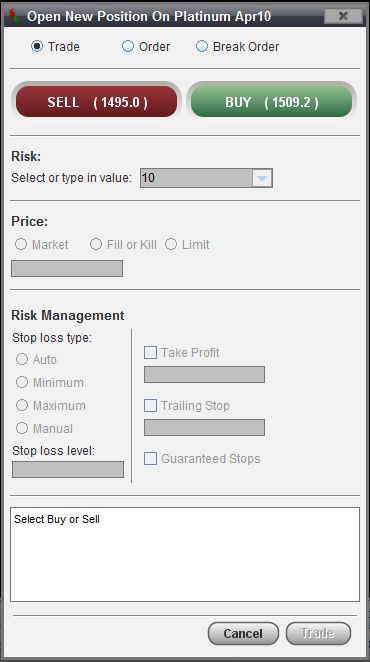

2.The Trade window will pop up. The Trade window is the primary window for trade & order entry.

2.1 Select a Transaction Type

There are three different transactions you may execute:

Trade

Select this option once if you want to place a Buy or Sell trade for the chosen product. This allows the System to request a price and provide a quote.

Order

Select this option once you would like to place a trade that will be activated only if and when your specified price level is reached.

NOTE: The entry price is not guaranteed. During times of high volatility, your orders might not get filled.

Break Order

Select this option if you confident that market is trading in a range and that a breakout is about to happen.

Example:

The DOW is currently in a range of 13100 - 13200. You believe that once the DOW breaks through 13200, the market will take off to 13500. You would then place a Break Order to execute on the Break out of 13200. The reverse remains true if the DOW breaks through 13100 on the downside.

If you have Break Order at a point above 13200 the Break Order would be triggered at the next available price. If the next GT247.com price (Last Traded & Bid in this instance) came through at 13200, your order would be triggered at the next GT247.com offer i.e. 13205. However, if the next GT247.com price were to have a big jump to 13300 (Last Traded & Bid in this instance) your order would be triggered at the next GT247.com offer i.e. 13305. Currently you cannot guaran- tee the Break Order price

|

NOTE: In times of high volatility, the market could gap in your direction and to a point well above your intended entry price.

It is imperative that you understand the formalities and intricacies of accurately structured trades and orders so as to prevent avoidable losses. See the Managing Risk section for more details on the various transaction types and examples detailing the effects of using the transaction types and application of risk management.

2.2 You can either Buy or Sell.

Click the ‘Sell’ button to go short alternatively click the ‘Buy’ button to go long.

Note: The updated Sell and Buy Price prices of the product will appear on the respective buttons on a continuous basis.

2.3 Select the amount of risk you want to place per change in the price from the drop down menu or alternatively input your own risk per point amount.

Example:

If you want to Sell the DOW at 13100 the amount to risk you specify here will determine how much you would earn for each point the DOW moves in your favour. It would also determine how much money you would be losing for each point the DOW moves against your position.

If the DOW moves down to 13050 points (in your favour) it would mean that you have earned 50 points. If you specified a risk of R10 per point, you would earn:

[(Risk x Points Earned) – (Risk x Spread)] = (10 x 50) - (10 x 5) = R 445.00

|

2.4 Select a price

Market

By selecting this option, you will pay the current Bid price should you sell. If you decide to buy, you will pay the current Offer price.

Note: In times of high volatility, the market could move away from the price it was reflecting from the time you clicked the “Trade” button and the transaction being completed. This is also known as Slippage.

Example:

When you clicked the “Trade” button to Sell the Dow at 13100, by the time the instruction reaches the market, the price could already have changed to 13080, 20 points lower than you anticipated. In cases like these, GT247.com will always contend the closest price to your initial price or better in the event that the price momentarily moved the other way. |

Fill or Kill

This option may be used to counter the issue of slippage. By choosing this option, you are giving instruction to either trade at the price you have specified or to cancel your instruction.

Example:

If you decided to sell the DOW at 13100, and chose the Fill or Kill option. When you click the Trade button, your order is sent to the market and if the price is still the same as it was when you clicked the Trade button, the transaction is done at that price i.e. it’s filled. However, if the price has changed, whether in your favour or against you, the instruction is immedi- ately cancelled i.e. it’s killed. |

2.5.1.1 Auto

This is the default level at which a Stop Loss is set. If you do not change it, your Stop Loss will be automatically calculated by GT247.com. Default Stop Loss levels are based on a 5 day historic volatility calculation done by GT247.com.

2.5.1.2 Minimum

The Stop Loss will be set to the minimum Stop Loss Level specified by GT247.com for the particular product. Refer to our online Futures Product List for the Minimum Stop Loss levels for the different products.

Example:

If you chose to Sell the DOW and opted for the “Minimum” Stop Loss level (assuming the DOW’s Minimum Stop Loss is 20 points). If the trade had to go against you by 20 points, the position will be closed out with a 20 point loss, plus the initial spread cost. |

NOTE: In times of high volatility, using this option alone is NOT a guarantee that the position would be closed out exactly at the chosen level. If the market is moving very fast, you could have a considerably larger loss than the initial 20 points. In such cases, GT247.com will contest the closest price to the anticipated exit price or better. To counter the above mentioned scenario, a Guaranteed Stop Loss could be used.

2.5.1.3 Maximum

Select this option if you wish to use the use the maximum allocated Stop Loss.

2.5.1.4 Manual

Select this option and enter the appropriate price level if you wish to manually control the maximum level at which the price would have to descend to before your position is closed out.

2.5.2 Take Profit

The Take Profit is similar to a Stop Loss, only referring to profits. Take Profits make sure that once your trade reaches a certain level of profit it will be closed. By setting a take profit level, you protect your profit in the case that your trade becomes unprofitable.

Example:

You Buy the DOW for 13500. After a few hours the price rises to 13650 but an hour later drops to 13350. Without a Take Profit, you might miss the rise in price and end up with a loss. |

As with Stop Losses, there is no guarantee that the trade will be closed at or near the chosen level because markets can gap past the Take Profit level. However with a Take Profit, this can only be to your benefit.

NOTE: Take Profits are only triggered whilst the product is open. Take Profits will only exit a transaction when the Last traded price trades at or above the Take Profit level.

To set a Take Profit level, simply select the Take Profit box and enter the level of profit you wish your trade to be closed out at in the adjacent box.

Limit

This option allows you to stipulate the maximum price you are willing to pay for the product. Enter maximum price that you are willing to pay in the input box after selecting the Limit option.

Example:

By choosing the Limit option, you wish to buy the DOW at the current price of 13200. In addition, you are aware of the market volatility and are prepared to pay up to but not more than 13215 to get filled. In affect you are giving instruction that should the trade order reach the market when the price has changed to but not more than 13215, it should still execute the trade. You are therefore providing the trade station with a 15 point range to compensate for possible Slippage. |

NOTE: The Fill or Kill and Limit price options do not apply to Orders or Break Orders.

2.5 Apply Risk Management tools

In order to assist you in limiting your exposure to loss, GT247.com offers a flexible range of risk management tools - all geared at reducing the risk of trading Futures.

2.5.1 Stop Loss type

A Stop Loss is mechanism you can use to limit the losses on an individual trade. When the loss on a trade reaches a predetermined level, your trade is automatically closed out. As part of the GT247.com Risk Management policy, you are required to select a mandatory Stop Loss level which is appropriate to your risk management strategy for each trade that you open.

Stop Loss Levels are not guaranteed because fast moving markets will often ‘gap’ past the preselected Stop Loss level. To counter this effect GT247.com offers a Guaranteed Stop Loss facility on certain products ensuring a guaranteed exit at your chosen Stop Loss level irrespective of market conditions for small premium.

Note: Stop Losses are ONLY triggered whilst the product you are trading is OPEN.

2.5.2 Trailing Stop

Trailing Stops allow you to track profitable positions automatically, while protecting yourself from market volatility. This means you do not have to monitor your open positions constantly and move your stops should the market move in your favour.

Trailing Stops can be applied, edited or removed at any time while a position is open. Once, you have selected the distance (specified number of points) you would like your stops to be moved, Future Trader will immediately start maintain- ing the stop offset. Trailing Stops must be scaled to the product tick size. See our full Futures product list on our website for applicable tick sizes.

Example:

Buy 10 EUR/USD @ 1.1130

Trailing Stop: 0.0020

Stop loss: 1.100

EUR/USD moves to 1.1150;

Stop Loss will be moved to 1.1120

Buy 10 DOW @ 9050

Trailing Stop: 20

Stop loss: 9000

Dow moves to 9070

Stop Loss will be moved to 9020

|

NOTE: If you do not select a Trailing Stop when entering the trade and only enter one later, the Stop Loss offset will be evaluated against the current Offer (Buy) and Bid (Sell) price. The Trailing Stop Loss is not a replacement for a normal Stop Loss.

To set a Trailing Stop, simply select the check Trailing Stop box and enter the number points you wish your stops to be moved by with every movement the market price experiences.

It is important to consider the following factors when using a Trailing Stop: a. The distance that will be maintained between the Stop Loss level and the market price. b. The size of the steps that your Stop Loss level will make as it follows the market price.

Example:

If we continue using the previous DOW example, we entered the market at 9050, but this time the DOW only moved up 10 points but then starts moving against us. With ONLY a Trailing Stop in place, our position is not protected because the DOW never moved the required 20 points to activate the Trailing Stop. |

NOTE: To limit losses that could occur before the Trailing Stop is activated, it would also help to enter a Manual Stop Loss at for example 10154 (which would constitute a 20 point fall in the Dow) using the “Manual” option.

2.5.3 Guaranteed Stop

With a Guaranteed Stop, you protect yourself from any possibility of slippage in the event of the market moving sharply against you. A Guaranteed Stop ensures that your position closes where you specify, however far the market may have moved through this level. With a Guaranteed Stop, an additional spread is added to your opening level – in effect, an insur- ance premium for this guaranteed risk protection.

NOTE: You can only apply a Guaranteed Stop when opening a new trade; however the Stop loss level can be moved at any time during the trade. Guaranteed Stops are applied to both the Stop Loss and the Trailing Stop.

The Guaranteed Stop is not available for all Spreads products. See our Product list on our website for a full list of the affected products.

To set a Guaranteed Stop to a new trade, simply check the ‘Guaranteed Stop’ box.

You will notice that the prices reflected on the Sell and Buy buttons will change to reflect the additional costs for using the Guaranteed Stop

Example:

The DOW has an 8 point change for this facility. If the DOW quote is [Bid: 10194 Ask: 10200] When the Guaranteed Stop Loss is chosen, the DOW quote will change to [Bid: 10186 Offer: 10208] to reflect the additional 4 point cost. |

2.6 Check your trade/ order setup

The Output box displays a summary of the trade/ order you are about to place and reflects which product is being traded, how risk per point was taken, the required margin for the trade and the price at which the manual Stop loss will trigger and any risk management tool selected. As you select/ deselect option in building up the trade, the information displayed in this box changes. This information will be stored in the Open Transaction window where you can view it at any time.

2.7 Place Trade/ Order

After checking your details carefully you can then make a trade by either clicking ‘Trade’ or an order by clicking ‘Order’. If you decide not to go through with the trade or order click ‘Cancel’

2.8 Successful Trade/ Order

If your trade/order was successfully placed, the confirmation will display in the Info window as well as the reference number for your trade. A confirmation will be sent to your e-mail address and your new position/ order will display in the Open Transactions window.

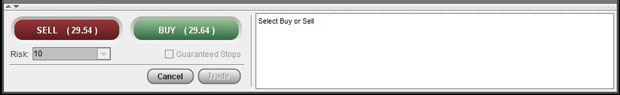

Placing a Trade using the Quick Trade Ticket

1. Select a product to be traded from a watchlist to automatically populate the Quick Trade Ticket.

2. Click the ‘Sell’ button to go short alternatively click the ‘Buy’ button to go long.

NOTE: The updated Sell and Price prices of the product will appear on the respective buttons on continuous basis.

3. Select the amount of risk you want to place per change in the price or input your own amount.

4. Set a Guaranteed Stop Loss by checking the Guaranteed Stop Loss box.

5. Check your trade setup in the Output box.

6. Once you are satisfied with your trade/ order setup. Click the ‘Buy/Sell’ button. If you decide not place the trade click ‘Cancel’.

7. If your trade was successfully placed, the confirmation will display in the Info window as well as the reference number for your trade. An e-mail confirmation will be sent to your e-mail address and your new position/order will display in Open Transactions window.

NOTE: Your Stop Loss level will default to Auto and Risk Management tools like Trailing Stops and Take Profits will have to be applied after the trade is placed. |