|

Managing Risk |

| Introduction to GT247.com |

Spread Trading offers great prospects for spectacular profits. This type of trading involves a high degree of risk and significant losses can easily become a reality. It is vital to engage in vigilant risk management. One of the most effective ways of limiting any potential losses are by using the automated risk management tools offered by GT247.com.

Using Stop Losses

A stop loss is an instruction to GT247.com to close your trade if your losses reach a certain level. Should your losses reach the specified level, your trade automatically terminates. Stop losses can be used, when buying or selling. With a buy trade, you place the stop loss below the opening price to protect you from a falling price, because you are anticipating a price rise. With a sell trade, on the other hand, you place the stop loss above your opening price to protect you from a rising price, because you are expecting the price to fall.

Using Guaranteed Stops

Stop Losses allows you to limit any potential losses on an open position. However, there are situations where it will not be possible to close s position at the specified level especially during times of high volatility GT247.com offers a protection against this called a Guaranteed Stop Loss. Regardless, of what happens, your trade will be closed at the exact price you have specified.

Locking in profits using Take Profit

Stop Losses act as a safety net preventing you from making big losses - you can also specify to close your position at a certain profit level. By using a Take Profit order, you can close position for a profit when the market reaches a level determined by you.

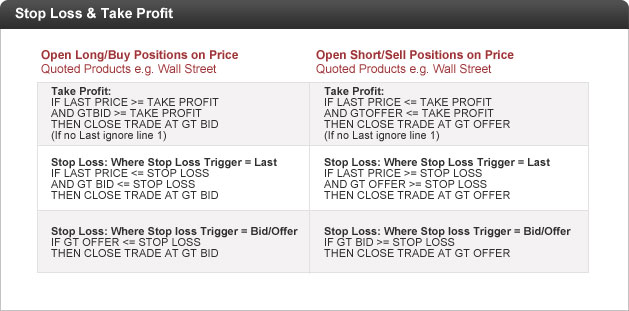

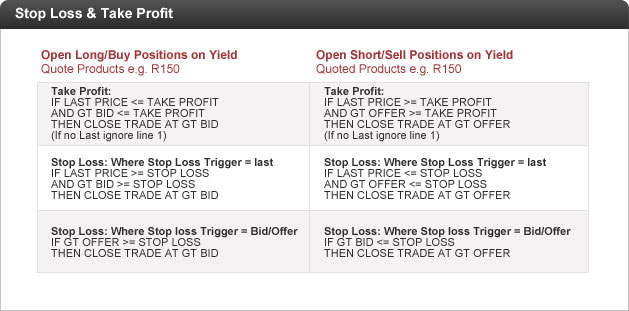

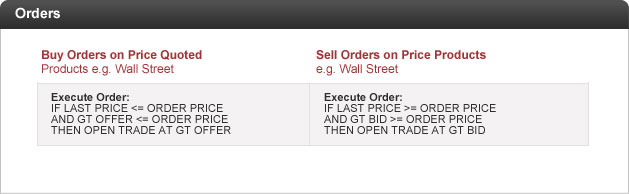

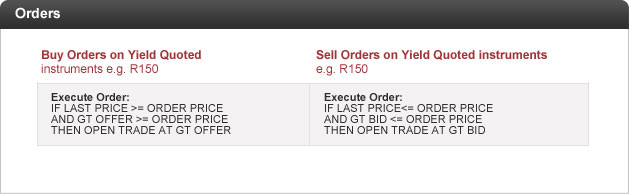

Triggering the Take Profit & Stop Loss Levels

This section details how the Take Profit and Stop Loss Levels are triggered. The effects of using each combination are also shown.

Trigger Points:

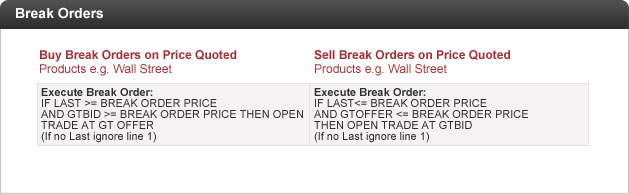

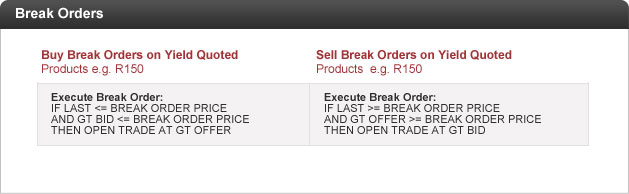

When there is a market with a Last, the Last will have to be beyond the trigger point as will either the Offer (in the case of a trigger which results in a buy) or the Bid (in the case of a trigger which result in a sell).

Where there is no Last, only the Offer (in the case of a trigger which result in a buy) or the Bid (in the case of a trigger which result in sells) will be required to be at a level beyond the trigger point, before the trade is triggered.

Refer to our online Spreads Product & Markets guide for the Stop Loss trigger applicable to each product.

|

|

| Spread Trading |

| Getting Started |

| Platform Overview |

| How To... |

| - Login, Switch Account or Logout |

| - Manage Watchlists |

| - View Underlying Instrument Prices |

| - Open new Position/Order |

| - Track Positions |

| - Edit Positions |

| - Close Positions |

| - Cancel an Order |

| - Roll Over a position |

| - Set a price alert |

| - Access Charts |

| - View Reports |

| - Customise Favourites Ticker |

| - Use the Information Window |

|

|

| |