|

Spread Trading |

| Introduction to GT247.com |

What is Spread Trading?

Spread Trading (OTC Futures) is one of the most exciting and potentially profitable ways to trade the world’s commodities, currencies and stock markets.

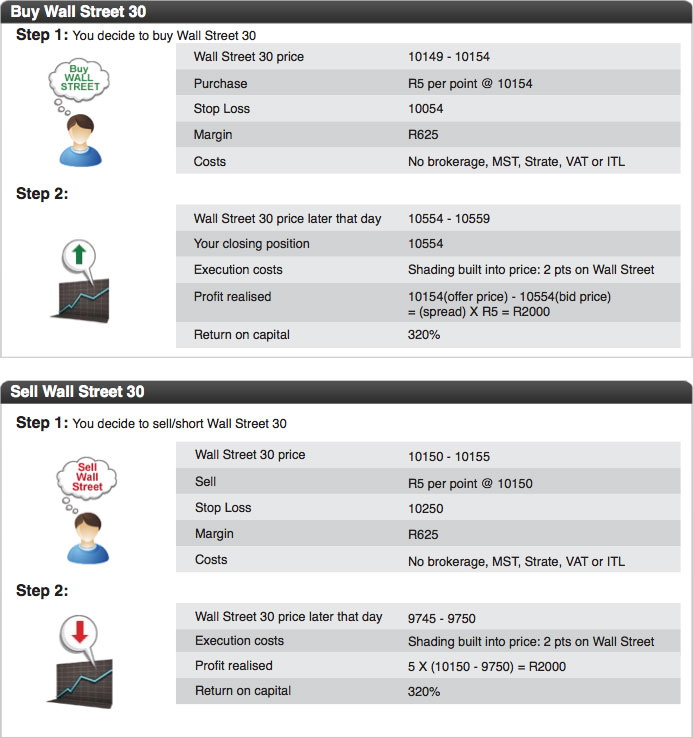

In simple terms, Spread Trading is a system that enables you to profit from movement in a share price without actually buying the share. If you ‘go long’ (buy) on the price, your profits will rise in line with any increase in that price. If you ‘go short’ (sell), your profits will rise in line with any fall. Similarly if you go long on the price and the underlying instrument price falls, you will incur losses. The major attraction of spread trading is that you can profit from a falling price in the same way as from a rising one - and you can achieve this with a relatively small amount of money.

Unlike trading ordinary shares, when you buy or sell, you're not buying or selling an actual share. You're entering into a futures contract - an agreement to buy or sell the share at a fixed price on a certain date. A July futures contract, for exam- ple, provides for delivery or settlement in July. You can close a trade at anytime by buying or selling an offsetting futures contract prior to the delivery date should you choose to do so. Contracts approaching expiry can optionally be ‘rolled over’ i.e. your trade is closed and similar trade is opened in the next contract period. Most contracts work on either a daily, monthly, quarterly or rolling basis.

As a leveraged product, Spread Trading only requires you to deposit a small percentage (margin) of the full value of your position. This means that the potential for profits, or losses, from an initial capital outlay is significantly higher than in traditional trading. The margin required is typically between 10% and 35% depending on the volatility and liquidity of the underlying instrument.

GT247.com offers futures trading on multiple financial markets around the world in South African Rand (ZAR) with flexible risk levels starting at R1 per point in the following asset classes:

- Commodities

- Currencies

- Indices

- Interest Rates

- Mini CFD South African Equities

For more information, consult our Products & Markets Guide.

Why trade Spreads?

Spread Trading offer a number of benefits.

- Low Costs: No brokerage, VAT or STRATE, commissions is built into the Spread.

- Profit from rising or falling markets: It is as easy to ‘go short’ (sell) as it is to ‘go long’ (buy). If you expect the value to fall you can sell today, with the expectation that you can buy back in the future at a lower price.

- Leveraged Trading: Spreads are traded on margin which means that you are only providing part of the money that you are trading with allowing you to place trades with a relatively small initial outlay.

- Limit your risks: Stop-losses are automatically applied to each trade you make. This means that no matter how volatile the price is, you can always limit your risks to your own comfort level.

- Trade Global Markets: Spread Trading provides instant access to financial markets around the world.

What are the risks

Although you can make substantial profits from Spread Trading it is important to note that it carries a high level of risk to your capital, so you should only trade with money you can afford to lose. GT247.com has a policy of attempting to limit client losses.

It is vital to ensure that you familiarise yourself with the risks involved and that Spread Trading matches your investment objectives. If you are new to trading, we highly recomend that you sign up for a free simulated trading account. Open a simulated Account online at www.gt247.com. If you want to know more about the risks involved, please read the risk warn- ing on our website.

Who trades Spreads?

- Investors who want to profit from both falling and rising markets.

- Traders who prefer to transact online in real time, without broker intervention, 24 hours a day.

- Investors who prefer to pay no brokerage, contract, exchange or back office fees.

- Former warrant traders who want a wider product range, better transparency and no time decay.

- Active investors with strong views on the market who want to maximise their potential returns.

- Professional investors looking for a low cost method to hedge their existing portfolios.

What are the advantages of Spreads Trading with GT247.com?

- Fully interactive online trading: Use our fully automated, real time trading platform to view both the underlying market prices and trade.

- Speed: Our Java applet based platform delivers a true speed advantage over browser based platforms

- No Dealer Intervention: Our trading platform provides market liquidity at the bid/ask prices shown with no dealer intervention.

- Limit Risk Trades: Guaranteed stops are available on certain products at the time the trade is opened.

- No exchange controls: With GT247.com you don’t have to convert your currency to that of the international instrument you are trading as your trade is based in ZAR.

- Price Transparency: There are no added costs or charges on top of the price you see on your trading platform.

- Small Minimum Trade Sizes: Rand risk per point allows you to trade in amounts of your choice starting at R1 per point.

- Tighter spreads: We offer a fixed percentage on either side of the underlying market value. You will be quoted narrow spreads across our markets, offering you the maximum opportunity to profit from your predictions for market movements.

- Convenience: You can do all your trading online or by simply phoning our trading desk.

|

Getting to grips with Spread Trading at GT247.com

Contracts

Whether you are a day trader or a long-term investor, GT247.com offers trading contracts to suit your specific trading style. You have a choice of four different contract periods:

Daily

Daily Contracts automatically expire at the end of the day so they suited to someone looking for a price movement within that time frame.

Monthly

Monthly contracts expire in the month stated in the contract itself. You have the option to roll over your trade into the next contract month should you wish.

Quarterly

Quarterly contracts are the most popular expiring in March, June, September and December. These terminate automati- cally at the end of quarter but can be extended into the next quarter.

Rolling Cash

Rolling Cash contracts have no expiry date as such but are open ended trades which can be held indefinitely. They are rolled over every night at the official closing price and a mark to market is run on a daily basis. Your trade is then reopened at the closing price plus or minus funding for the position. Rolling over of trades is done after the market closes in the evening.

Orders

In order to assist you in limiting your exposure to loss, GT247.com offers a flexible range of orders (automated instruc- tions) that can be used to either limit your losses or realize profits at specified levels. Spread trading as with many other forms of financial speculation can carry a relatively high degree of risk. A variety of order types can be placed to get in and out of the market with ease. In Future Trader, two orders exist:

Normal Order:

When placing a normal order, the price you stipulate to buy or go long will be below the current Offer price and similarly the price stipulate to sell will be above the current Bid price.

Break Order:

When placing a break order, you buy or go long the stipulated offer price should be above the current market offer price and when selling or going short, the stipulated price should be below the current bid price.

Rollovers

With the exception of Rolling Cash & Mini CFD contracts, all GT247.com contracts have a definite expiry date. This means that the contract will close on that date, with the closing price based on the price set by the relevant stock exchange. To extend your contract beyond this date, you can roll your position over into the next contract period. Contracts that have been rolled over have a new expiry date unless risk management functions like the Stop Loss or Take Profit have been triggered.

Note: Unless you select instrument roll-over on the trading platform or contact the trading desk prior to GT247.com's closing time on the expiry day, your open position will be closed out at the published expiry price.

Rollover Process Explained:

Your open Sep10 position will be closed out at the middle of the GT spread, hence realising a profit or loss on the position. Your Dec10 position will then be entered at the GT Bid or Offer.

Note: Should this Rollover result in you realising a loss on that position you will be required to replace the lost margin = to the loss incurred in order to maintain the original Risk. If you do not have sufficient funds available to facilitate this process your Risk will be reduced to a level that you are able to fund.

Rolling Cash contracts, how do they differ from rollovers?

Rolling Cash contracts are open ended contracts which will never need to be rolled over unless you alter the default rollover properties for this product type. Rolling Cash is most popular with short-term traders and offers significant advan- tages:

- They are a cost-effective alternative to quarterly contracts because the spread is tighter, thereby increasing the opportunity for profitable trading.

- If you are going short (selling), Rolling Cash contracts attract income to your account due to overnight financing.

Whilst Rolling Cash contracts are more flexible than regular contracts, you should bear in the following in mind:

- If you go long (buy), Rolling Cash Contracts incur an interest charge each time they are held open overnight. This charge is levied directly to your trading account.

- If you go short (sell), Rolling Cash Contracts earn interest each time they are held open overnight. The interest earned is credited directly to your trading account.

|

|

| Spread Trading |

| Getting Started |

| Platform Overview |

| How To... |

| - Login, Switch Account or Logout |

| - Manage Watchlists |

| - View Underlying Instrument Prices |

| - Open new Position/Order |

| - Track Positions |

| - Edit Positions |

| - Close Positions |

| - Cancel an Order |

| - Roll Over a position |

| - Set a price alert |

| - Access Charts |

| - View Reports |

| - Customise Favourites Ticker |

| - Use the Information Window |

|

|

| |